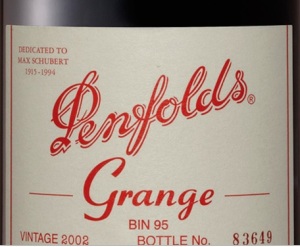

I confess, I once accepted a bottle of Penfold’s Grange at a business lunch.

I confess, I once accepted a bottle of Penfold’s Grange at a business lunch.

Unlike former NSW premier Barry O’Farrell I do distinctly remember the occasion and the circumstances of receiving the Grange.

It was in the winter of 2007, a year or so before the collapse of investment bank Lehman Brothers that ignited the US sub-prime mortgage crisis and the Global Financial Crisis (GFC), when money was still flowing like…err…fine wine.

The venue was La Grillade, an upmarket restaurant in Crow’s Nest on Sydney’s North Shore famous as much for its succulent steaks and extensive wine list as for being a favourite venue for the big wigs media execs from nearby Channel Nine.

“Let’s get a bottle of Grange” I remember the already sloshed media man proclaiming as he flashed an intoxicated grin around the room and his gold-plated corporate credit card.

There were four of us at the table at the back of the restaurant and large amounts of alcohol had already been consumed.

This was back in the days when the long, boozy lunch was still part of a journalist’s weekly repertoire, before concepts like “the 24 hour news cycle” and “social media’ ruined all that.

The group consisted of myself (very drunk), my colleague at the same North Shore publishing company where we edited our respective mortgage broking titles (also drunk) and our hosts, the very cheery media man (pissed, loud and notoriously bad at holding his alcohol) and his client, a gold-watch-and-necklace-wearing businessmen of Eastern European extraction, a classic self-made Aussie battler, riding the wave of easy money.

It was one of those gray, Sydney winter’s days when the thought of spending the afternoon carving into a perfectly cooked steak in a cozy expensive restaurant with someone else footing the bill sounded like a good idea.

Our host’s line of work? He ran a mortgage broking outfit targeting credit-impaired borrowers via ads which ran on the horse racing channel – classy!

The point of it all? A big boozy lunch hopefully in return for a favourable article about our host’s mortgage business, a modus operandi not uncommon in the ethically challenged world of trade publishing.

The bottle of grange made its star appearance late in the proceedings. Plied with countless beers beforehand, it was wasteful gesture in the extreme. More so because not only was I unable to appreciate the expensive drop, but I distinctly recall leaving the table without finishing my glass or helping our hosts polish off the bottle (surely a worse crime than denying ever receiving the bottle in the first place, Barry?).

Even more bizarrely, the last thing we drank was Sambuca, a licorice-flavoured liquor, which would have washed out what little my taste buds remembered of the dark red Grange nectar.

So I have no recollection of how good it tasted. For all I know, it could have come out of a cask. Still relatively new to the excesses of corporate lunches (I would soon learn) I also knew nothing about this so-called mystical Grange. All I comprehended at the time was the price – about $1200.

As the sun sunk from view, the cheque was ordered and duly paid. We said our goodbyes amid back-slapping, laugher and nudges and winks from our hosts.

My colleague and I made our way grimly back in the cold to our St Leonard’s office, an uphill walk after an over-indulgent meal with expensive steaks sloshing uneasily amidst the alcohol in our stomachs. I confess I felt out of it.

The irony: neither of us wrote a word about our host and his mortgage broking company that advertised on the racing channel. Or about his office lined with sporting memorabilia. Or his desire to be a larger-than-life mortgage lender in the mould of Aussie John Symond.

Later in that same year I bumped into our host at another function, the Melbourne Cup. It was another boozy affair. Bob Downe was the host and did his “Kevin 07” impression. It was a different era.

Two years later with the financial crisis in full swing, I read on the NSW Fair Trading website of a mortgage broker that had narrowly avoided going to jail after being found guilty of taking advantage of his clients and pocketing huge commissions for each home loan he granted. His business was placed in the hands of administrators and was eventually wound-up.

It was our host and Penfolds Grange purveyor.

The latest edition of Penfolds Grange, the 2009 vintage, was recently released for sale. According to Penfolds chief marketing officer Simon Marton the Barry O’Farrell fiasco increased its luxury cache. Wine experts say it’s still a good drop (you’d hope so at $785 a bottle) – but not of the quality of previous vintages.

Clearly, it’s also not in the same league ast the 1959 bottle that brought down a NSW Premier.

But is it any better than the 2003 vintage I drank six years ago at a long lunch in Crow’s Nest. I wish I could tell you.

(A further note to this sordid tale – the restaurant La Grillade didn’t fare so well either. It shut it’s doors in December 2011 after apparently losing the patronage of its media clientele. It re-opened under new management and still bears the same name. A marbled wagyu steak sets you back $55).

Larry, good story and nicely put! I am afraid there wil always be corruption and unscrupulous people among us. It is the same all over the world. Temptation is a double-bladed sword, and I am glad you are on the blunt side of it!

LikeLike

Thanks Tim. Yes, if u watched Four Corners you would have seen the degree of corruption at our biggest financial institution the Commonwealth Bank

LikeLike